Your Oregon cat tax calculation images are available. Oregon cat tax calculation are a topic that is being searched for and liked by netizens today. You can Get the Oregon cat tax calculation files here. Find and Download all royalty-free photos.

If you’re searching for oregon cat tax calculation images information related to the oregon cat tax calculation topic, you have come to the right blog. Our site always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

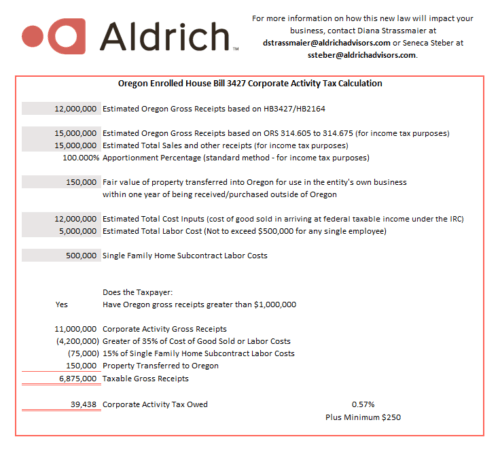

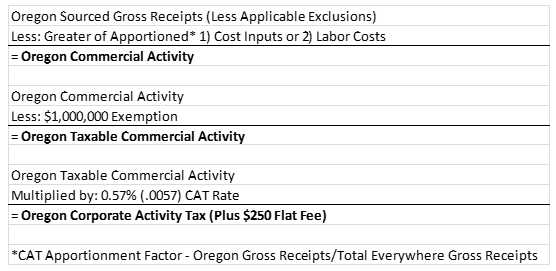

Oregon Cat Tax Calculation. At this point the CAT calculation becomes less complex. Or Labor costs. Once the amount of commercial activity sourced to Oregon is determined the CAT imposed is equal to 250 plus the product of the taxpayers taxable commercial activity for the calendar year in excess of 1 million multiplied by 057. Determine your Oregon Corporate Activity Tax liability.

The tax is computed as 250 plus 057 percent of taxable Oregon commercial activity of more than 1 million. Our calculator has been specially developed in order to provide the users of the calculator with not only how much. The new Corporate Activity Tax CAT will be imposed on taxable commercial activity in excess of 1 million at a rate of 057 plus a flat tax of 250. The tax is computed based on a calendar year beginning Jan. Multiply this number by total labor costs or cost of inputs paid to other businesses. Last year Oregon Governor Kate Brown signed House Bill HB 3427 imposing a new gross receipts tax effective for tax years beginning on or after January 1 2020.

The Oregon CAT defines cost inputs as the cost of goods sold as calculated under IRC Section 471.

The Oregon Wheat Growers League joins its partners in celebrating a major win for agriculture today with the passage of agriculture-specific fixes to the Corporate Activity Tax CAT. Multiply this number by total labor costs or cost of inputs paid to other businesses. A taxpayer subject to CAT is allowed a subtraction of 35 of the greater of the taxpayers annual cost input or labor costs against Oregon - source commercial activity ie base of the tax HB. It was 074 for 2019 and is set to increase 01 each year through 2025 when the rate will reach and then stay at 080. Suite 110 Hillsboro OR 97123-8187. Oregon was one of the first Western states to adopt a state income tax enacting its current tax in 1930.

Source: mossadams.com

Source: mossadams.com

F or 2020 the LTD tax rate is 075. The CAT is applied to Oregon taxable commercial activity in excess of 1 million. This step is multiple flowcharts worth of calculations. The Oregon CAT defines cost inputs as the cost of goods sold as calculated under IRC Section 471. Multiply the result by 057 percent tax rate plus 250.

Source: aldrichadvisors.com

Source: aldrichadvisors.com

You are able to use our Oregon State Tax Calculator to calculate your total tax costs in the tax year 202122. Oregon wheat Growers League. Taxable Oregon Commercial Activity 1 million x 0057 250 Oregon CAT liability If you have additional questions please send them to the CAT policy team at. Oregons CAT is measured on a businesss commercial activitythe total amount a business realizes from transactions and activity in the normal course of business in Oregon. Oregon Salary Tax Calculator for the Tax Year 202122.

Source: jrcpa.com

Source: jrcpa.com

Oregon wheat Growers League. The CAT is applied to Oregon taxable commercial activity in excess of 1 million. The CAT is not a transactional tax such as a retail sales tax nor is it an income tax. The new Corporate Activity Tax CAT will be imposed on taxable commercial activity in excess of 1 million at a rate of 057 plus a flat tax of 250. It was 074 for 2019 and is set to increase 01 each year through 2025 when the rate will reach and then stay at 080.

The CAT is applied to Oregon taxable commercial activity in excess of 1 million. An amount equal to 80 percent of the tax computed on annualized taxable commercial activity. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. It was 074 for 2019 and is set to increase 01 each year through 2025 when the rate will reach and then stay at 080. Determine the total amount of commercial activity sourced to Oregon that the business realized over the course of the year.

F or 2020 the LTD tax rate is 075. If your taxable Oregon commercial activity is 1 million or less your CAT. The new Corporate Activity Tax CAT will be imposed on taxable commercial activity in excess of 1 million at a rate of 057 plus a flat tax of 250. You are able to use our Oregon State Tax Calculator to calculate your total tax costs in the tax year 202122. However taxpayers including unitary groups exceeding 750000 of Oregon commercial activity are required to register for the CAT within 30 days of meeting the threshold.

![]() Source: brennercpa.com

Source: brennercpa.com

The tax is computed based on a calendar year beginning Jan. You are able to use our Oregon State Tax Calculator to calculate your total tax costs in the tax year 202122. F or 2020 the LTD tax rate is 075. Oregons CAT is measured on a businesss commercial activitythe total amount a business realizes from transactions and activity in the normal course of business in Oregon. From Oregon and divide by sales everywhere.

Although HB 3427A refers to a corporate activity tax the tax applies to many forms of businesses including. If your taxable Oregon commercial activity is 1 million or less your CAT. Oregon Income Taxes. Ad Get your taxes sorted with our easy to use calculator. Multiply this number by total labor costs or cost of inputs paid to other businesses.

An amount equal to 80 percent of the tax computed on annualized taxable commercial activity. A taxpayer subject to CAT is allowed a subtraction of 35 of the greater of the taxpayers annual cost input or labor costs against Oregon - source commercial activity ie base of the tax HB. The 1 million commercial activity exemption is applied to. Multiply the result by 057 percent tax rate plus 250. The Oregon CAT is a tax on modified gross receipts because it provides taxpayers with a subtraction from taxable commercial activity of 35 percent of the greater of the taxpayers annual.

Signed on May 16 this new corporate activity tax CAT will be owed by companies with annual in-state revenues exceeding 1 million and is anticipated to raise 1 billion per year for Oregon schools. Apply a 76 corporate income tax rate on corporate income above 1 million. Multiply the result by 057 percent tax rate plus 250. The CAT is applied to Oregon taxable commercial activity in excess of 1 million. While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet.

Source: mossadams.com

Source: mossadams.com

Register for the Corporate Activity Tax. Last year Oregon Governor Kate Brown signed House Bill HB 3427 imposing a new gross receipts tax effective for tax years beginning on or after January 1 2020. It consists of four income tax brackets with rates increasing from 475 to a top rate of 99. Our calculator has been specially developed in order to provide the users of the calculator with not only how much. 1 2020 regardless of a taxpayers year end for accounting and federal income tax purposes.

The CAT is applied to taxable Oregon commercial activity in excess of 1 million. Amount of commercial activity sourced to Oregon. Businesses subject to the CAT will be taxed at a rate of 057 on taxable receipts less deductions. If your taxable Oregon commercial activity is 1 million or less your CAT. You are able to use our Oregon State Tax Calculator to calculate your total tax costs in the tax year 202122.

If your taxable Oregon commercial activity is 1 million or less your CAT. Estimated tax payment is equal to or more than 25 percent of any one of the following. From Oregon and divide by sales everywhere. Oregons CAT is measured on a businesss commercial activitythe total amount a business realizes from transactions and activity in the normal course of business in Oregon. Apply a 66 corporate income tax rate on corporate income up to 1 million.

Although HB 3427A refers to a corporate activity tax the tax applies to many forms of businesses including. A single entity company files tax returns in Jurisdiction A that has an enacted statutory tax rate of 9 In 20X0 the company apportioned 100 of its income to Jurisdiction A At the end of 20X0 the company had net taxable temporary differences of 500 expected to reverse at various times over the next 5 years. 1 2020 regardless of a taxpayers year end for accounting and federal income tax purposes. Last year Oregon Governor Kate Brown signed House Bill HB 3427 imposing a new gross receipts tax effective for tax years beginning on or after January 1 2020. While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet.

Source: jrcpa.com

Source: jrcpa.com

While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet. The CAT is not a transactional tax such as a retail sales tax nor is it an income tax. The tax is computed based on a calendar year beginning Jan. Determine your Oregon Corporate Activity Tax liability. Suite 110 Hillsboro OR 97123-8187.

Source: bluestonehockley.com

Source: bluestonehockley.com

It was 074 for 2019 and is set to increase 01 each year through 2025 when the rate will reach and then stay at 080. It consists of four income tax brackets with rates increasing from 475 to a top rate of 99. The Oregon Wheat Growers League joins its partners in celebrating a major win for agriculture today with the passage of agriculture-specific fixes to the Corporate Activity Tax CAT. While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet. How to calculate Corporate Activity Tax CAT Line 1.

Source: vbjusa.com

Source: vbjusa.com

Supports IRS FIFOSpecific ID. It consists of four income tax brackets with rates increasing from 475 to a top rate of 99. Use exception 3 on Form OR-QUP-CAT. If the taxabl e commercial activity is 1 million or less the taxpayer owes no tax under the CAT22 If the taxable commercial activity exceeds 1 million the taxpayer owes a tax of 250 on the first 1 million and the excess taxable commercial activity over 1 million is taxed at the. Suite 110 Hillsboro OR 97123-8187.

Source: pikesnw.com

Source: pikesnw.com

If your taxable Oregon commercial activity is 1 million or less your CAT. Oregons CAT is measured on a businesss commercial activitythe total amount a business realizes from transactions and activity in the normal course of business in Oregon. Our calculator has been specially developed in order to provide the users of the calculator with not only how much. Although HB 3427A refers to a corporate activity tax the tax applies to many forms of businesses including. Businesses subject to the CAT will be taxed at a rate of 057 on taxable receipts less deductions.

Subtraction from gross receipts. Oregons CAT is measured on a businesss commercial activitythe total amount a business realizes from transactions and activity in the normal course of business in Oregon. That top marginal rate is one of the highest rates in the country. If your taxable Oregon commercial activity is 1 million or less your CAT. Amount of commercial activity sourced to Oregon.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oregon cat tax calculation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.